Not known Factual Statements About Bill Nelson Real Estate Group

Wiki Article

6 Simple Techniques For Bill Nelson Real Estate Group

Table of ContentsAll about Bill Nelson Real Estate GroupAn Unbiased View of Bill Nelson Real Estate GroupThe Ultimate Guide To Bill Nelson Real Estate GroupThe smart Trick of Bill Nelson Real Estate Group That Nobody is Talking AboutSome Known Factual Statements About Bill Nelson Real Estate Group More About Bill Nelson Real Estate Group

You're not interested in monthly rental fees when turning a house. Instead, you require to acquire a home for the most affordable possible price if you desire to make an excellent revenue when marketing.

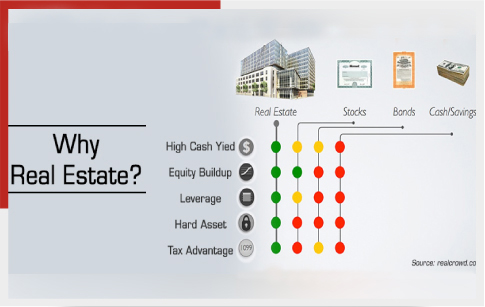

Expanding your financial investment portfolio is necessary. If you place all your eggs in one basket, you could experience a failure in the blink of an eye. However when you invest some funds in the supply market, various other funds in bonds or ETFs, as well as some in actual estate, you raise your chances of greater profits as well as less losses.

Some Known Incorrect Statements About Bill Nelson Real Estate Group

Neither is exact, and also to guarantee you, right here are 8 great factors why property is a great investment. The Leading Factors Realty Is a Great Financial investment If you're thinking of spending in realty, you will get started on among the very best investment trips of your lifetime.There aren't too many various other financial investments that allow you to buy properties worth much more than you have to invest. For instance, if you have $10,000 to spend in the stock exchange, you can typically acquire simply $10,000 well worth of supply. The exemption is if you buy margin (borrow), yet you should be an accredited investor with a high net well worth to make that happen.

For instance, allow's say you found a residence for $100,000; if you place down $10,000, possibilities are you might locate a funding to fund the rest as long as you have great credit scores and also secure revenue. Keeping that, it suggests you spend simply 10% of the possession's worth as well as have it.

Getting My Bill Nelson Real Estate Group To Work

Unlike stocks or bonds, you can force the property to appreciate. It seems strange, yet it's possible. Understand that genuine estate appreciates normally. On standard, realty appreciates 3% 5% a year without you doing anything other than preserving the home. You can raise the price of gratitude by making remodellings or repairs.You won't obtain a dollar-for-dollar return on your financial investments, yet some renovations can pay you back as high as 80% 90% of the money invested. The restorations do not need to be significant either. Naturally, adding a space or ending up the basement will add even more value than simple cosmetic renovations, but also small kitchen and washroom remodellings can significantly impact a house's well worth.

Yet, while it's a financial investment, when you have a house and also rent it out, you run a service you are the property manager. As business proprietor, you can frequently cross out the adhering to expenses: The mortgage interest paid on the lending Origination factors paid on the loan Upkeep costs Depreciation (spread out over 27.

How Bill Nelson Real Estate Group can Save You Time, Stress, and Money.

When you purchase supplies or bonds, you can just create off any type of capital losses if you market the asset for much less than you spent visit here for it. bill nelson real estate group. If you acquire and hold genuine estate, you can gain month-to-month money circulation renting it out, as well as this raises the benefit from owning property because you aren't counting only on the admiration but the monthly rental revenue.Roofstock Market is a great resource. They not only checklist available investment homes available for sale, yet a lot of them have tenants with leases in area currently. When you purchase the home, you promptly end up being a property manager. Roofstock also offers a lot of due diligence, investigating you, so all you need to do is get the home you assume is finest.

There's not much to really feel safe regarding when you spend in the market. When you invest in actual estate lasting, you recognize you have a valuing asset.

The Ultimate Guide To Bill Nelson Real Estate Group

Many individuals spend in realty to supplement their retirement earnings. Whether you possess the property while you're retired, earning the month-to-month rental capital to supplement your earnings, or you sell a property you have actually had for years as soon as you remain in retired life and also make a revenue, you'll raise your retired life income./real-estate-investing-101-357985-final-5bdb4da04cedfd0026ac6b3f.png)

If purchasing realty and renting it out is as well difficult for you, there are numerous various other methods to buy property, including: Get an underestimated residential or commercial important site property, repair it up and flip it (fix and also flip) Be a dealer working as the middle guy in between inspired sellers as well as a network of buyers.

Buy an Actual Estate Financial Investment Count on If you wish to leave a legacy behind however do not believe going money is a great idea, passing property down can be also better. Not just will you offer your successors an income-producing possession, yet it's likewise a valuing possession. They can either maintain the residential or commercial property and allow the tradition proceed or sell it and also earn earnings.

The 45-Second Trick For Bill Nelson Real Estate Group

While there's not a one-size-fits-all solution, there specify attributes to look for when you buy realty, consisting of: Look for a look at this now location that's attractive for renters or with fast appreciating residences. Ensure the area has all the features as well as eases most property owners want Take a look at the location's criminal activity price, institution scores, as well as tax history.

Report this wiki page